Ottawa's ramped up defence-spending plans will give the economy a lift, but not enough to save it from a recession, a newly released report forecasts.

The updated analysis from Oxford Economics published Wednesday projects that Canada's defence spending commitments will raise the country's real gross domestic product by a tenth of a percentage point this year and next.

That would bring growth up to 0.9 per cent annually this year and 0.4 per cent in 2026.

Barrie's News Delivered To Your Inbox

By submitting this form, you are consenting to receive marketing emails from: Central Ontario Broadcasting, 431 Huronia Rd, Barrie, Ontario, CA, https://www.cobroadcasting.com. You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact

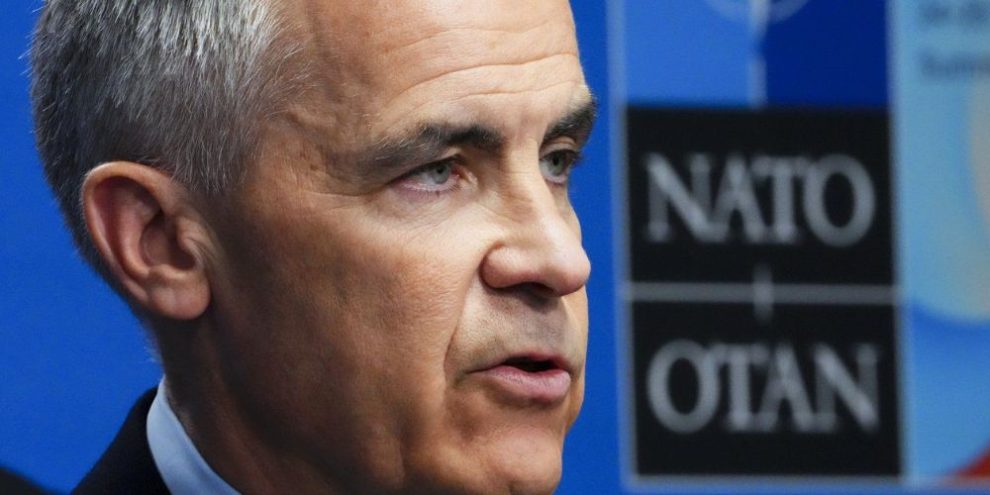

Prime Minister Mark Carney announced plans last month to reach NATO's defence and security spending target of two per cent of GDP by the end of this year. New member commitments from last month's NATO summit will see that funding ramp up to five per cent of GDP by 2035.

Oxford Economics assumes that the accelerated defence spending will be financed by a larger deficit from the federal government; the latest forecasts were prepared before Ottawa announced a plan last week to trim operations spending by 15 per cent in the next three years.

The federal government is planning to publish its 2025 budget in the fall after forgoing the traditional spring fiscal update.

Without associated savings, the higher defence spending would mean a permanently higher debt-to-GDP ratio for the federal government, the report argued.

The defence-driven bump in real GDP also won't be enough to lift Canada out of the "trade war-induced recession" that's already underway, Oxford Economics said in the report.

The firm expects the economy shrank last quarter and that the current recession will last through to the end of the year for a total decline of 0.8 per cent in real GDP before the contraction is over.

While the labour market has held up relatively well so far amid Canada's tariff dispute with the United States — the economy added roughly 83,000 jobs last month, surprising most economists — Oxford Economics thinks the resilience will be short-lived.

"U.S. trade policy uncertainty and new tariffs will continue prompting firms to postpone or cancel investment plans, cut production, curb hiring and increasingly lay off workers," the report read.

The firm projects 140,000 job losses to come in the recession as impacts broaden past tariff-related sectors. That would push the unemployment up to 7.6 per cent later this year from 6.9 per cent seen in June.

Oxford Economics expects the Bank of Canada will keep its policy rate on hold at 2.75 per cent through this turbulence, though the firm said it can't rule out an additional rate cut or two from this point.

The report also projects inflation to rise to three per cent by mid-2026, effectively handcuffing the central bank from delivering much stimulus in the form of lower borrowing costs.

"The recession and rise in inflation will trigger an increase in private sector defaults and distressed home sales, raising the risk of a deeper recession, a sharp correction in home prices, or an unlikely financial crisis," the report read.

Oxford Economics' analysis is largely based on today's tariff levels between Canada and the United States persisting for the rest of the year.

The recession could deepen if U.S. President Donald Trump makes good on his threat to impose 35 per cent tariffs on Canadian goods starting Aug. 1, the report noted, while a new economic and security pact by that date could instead offer significant relief.

Despite those impacts, Oxford Economics positions Canada relatively favourably when it comes to economic risk.

The firm gauges how risky the outlooks are for major advanced economies based on a variety of factors including exchange rates, credit ratings and other domestic market dynamics.

At a risk score of 3.3 out of 10, Canada ranks 27th out of 164 countries evaluated by Oxford Economics. That puts the country below the United States, Australia, France and Germany but above Mexico, Japan and China.

This report by The Canadian Press was first published July 17, 2025.