Lower income doesn’t mean lower priority when it comes to filing a tax return.

Students in particular might skip filing a return if they earned little to no income last year, or are swamped with assignments and exams — but that means missing out on a number of benefits.

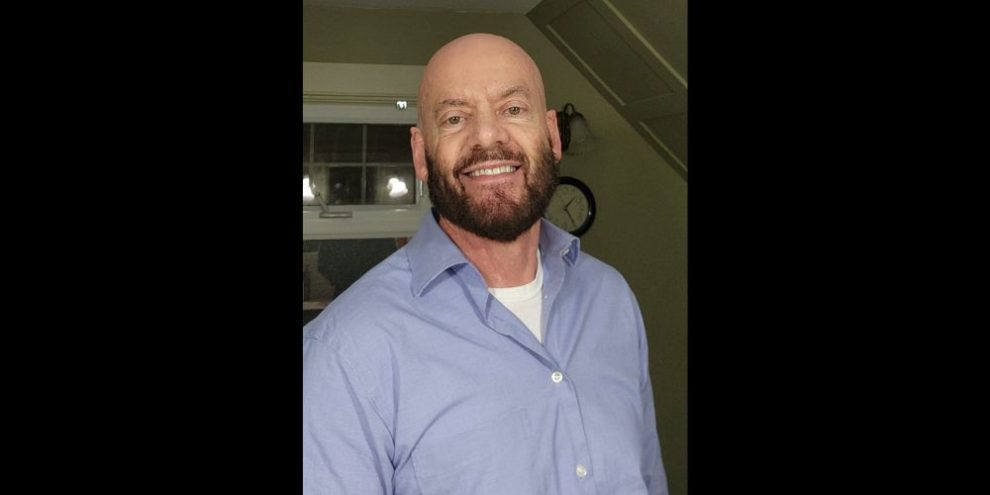

“For students, for example, filing their return, they can get access to several credits and benefits that are automatically paid just because they filed their return,” said Yannick Lemay, senior tax expert at H&R Block.

These include the GST/HST credit and the Canada carbon rebate, he said.

Those born before April 1, 2006, will have automatic access to these tax credits, Lemay added, because recipients have to be at least 19 years old at the time of receiving the payment. The GST/HST refund is available to those with low-to-modest incomes, according to the Canada Revenue Agency, whereas the carbon rebate is not based on earnings.

The Canada carbon rebate applies to every province except B.C. and Quebec, and the territories, Lemay pointed out.

Payouts for both can be a couple hundred dollars, several times a year.

The GST/HST and carbon rebates are unique in the tax world, said Joel Gillis, owner of The Tax Depot in Halifax. Most tax credits and deductions lower your tax payable amount, but don’t necessarily mean you’ll get cash back.

“We call them refundable credits, so you actually put money in your pocket,” Gillis said. “The quarterly credits will be a reason to file, even if there’s no income, basically.”

Tuition is another reason students should file every year — their deductions can be significant, and they accumulate as they’re carried forward. But it’s often a blind spot for people in school, Gillis said.

“I see this every day, a lot of students that we encounter, they do a four-year degree, but they won’t necessarily file because they don’t want to, or they forget,” he said. “And they don’t need the tax deduction for their tuition, so they don’t care.”

Barrie's News Delivered To Your Inbox

By submitting this form, you are consenting to receive marketing emails from: Central Ontario Broadcasting, 431 Huronia Rd, Barrie, Ontario, CA, https://www.cobroadcasting.com. You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact

Once they are out of school and working, however, these graduates want to claim tuition — a major deduction — but now they have to file all prior years to carry it forward, Gillis said. At that point, it would have made more sense to just file each year and collect the GST/HST and carbon payouts all along. Students can also transfer tuition credits to their parents, he added.

Another thing that accumulates with filing taxes: RRSP contribution room.

Once workers have earned income, Lemay said, “you accumulate 18 per cent of your earned income, up to a maximum, every year” in contribution room for your retirement savings.

Filing with the CRA also creates a financial document that can unlock various government programs — essentially taxes are your proof of income. And if your income is low or modest, there might be resources for you.

“There are many situations where filing your tax return is critical to get access to many government benefits,” Lemay said, pointing to COVID-19 benefits and, more recently, the Canadian Dental Care Plan.

To that end, Lemay said H&R Block runs free tax clinics in 20 cities across Canada for people without a fixed address or bank account, or even government ID, who are unable to access benefits and programs. The CRA also runs free clinics across the country — in 2022, nearly 650,000 individuals filed a return using these free services.

People with children will definitely want to access the Canada child benefit, Gillis said, and for non-students with lower incomes, the Canada workers benefit is another payout.

“[The Canada workers benefit has] been around for a while, but they changed it recently, where if you qualify under a certain income level, last year they started paying those payments out, almost like GST, in advance,” Gillis explained.

“Rather than just helping the person at tax time if they’re in a low-income status, they’re actually paying them before the end of the year. That’s probably one of the newest things.”

As soon as someone starts earning any kind of income, pays for tuition, is close to turning 19, or needs government benefits — whichever happens first — filing tax returns with the CRA has benefits. In many instances, that will be a teenager with their first part-time job.

“Whenever a teenager starts making a little bit of money, even if it’s a small amount, it’s worthwhile,” Gillis said.

This report by The Canadian Press was first published April 16, 2024.