Toronto

Ontario is scrapping its portion of the harmonized sales tax on eligible purpose-built rental housing in an effort to spur construction.

The province has been saying it would remove its eight per cent portion of the tax if the federal government dropped the five per cent goods and services tax on rental housing builds.

The federal government did that last month.

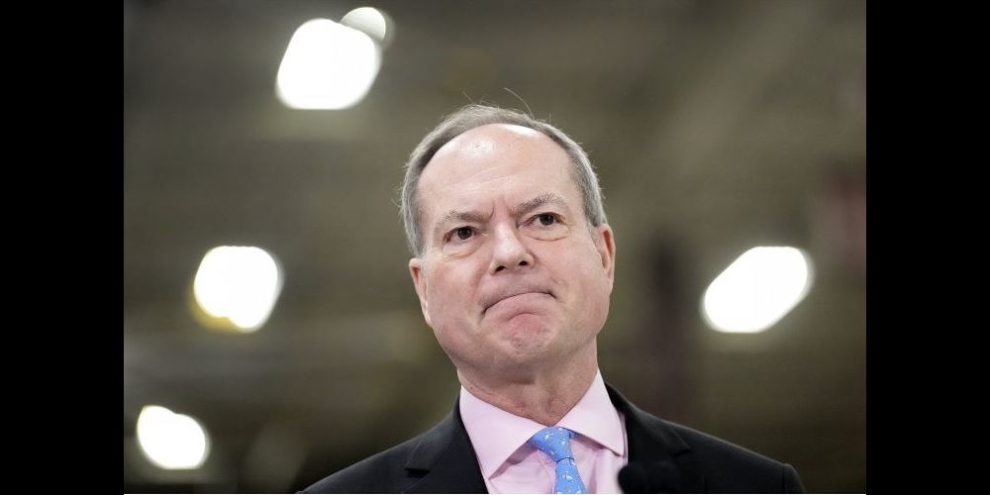

Ontario Finance Minister Peter Bethlenfalvy says the changes will apply to new rental housing units such as apartment buildings, student housing and senior residences built for long-term care rental accommodation.

The rebates apply to projects that began construction from this past September until Dec. 31, 2030.

To qualify, new residential units must be in buildings with a minimum four private apartment units or 10 private rooms, and be in a building where 90 per cent of units are long-term rentals.

This report by The Canadian Press was first published Nov. 1, 2023

Banner image via The Canadian Press